One of the most commonly asked questions from readers has been how to figure out what should be cut from your budget. Now for anyone that’s never struggled financially, this may seem like a silly question to ask, but it’s not. When you’re deep in the darkness of financial hell, it’s overwhelming and trying to figure out where to start is even more of a struggle.

So, how to figure out what expenses to cut from your budget…

Log in to your online banking, go to your checking account, click where it says “download transaction activity” or something similar and save it as an excel file.

Now, you can choose to go back three months or just month but if you’re struggling with where to start budgeting, you’ll want to go back three months. I warn you, this will take some time to complete but it’ll be so worth it in the end.

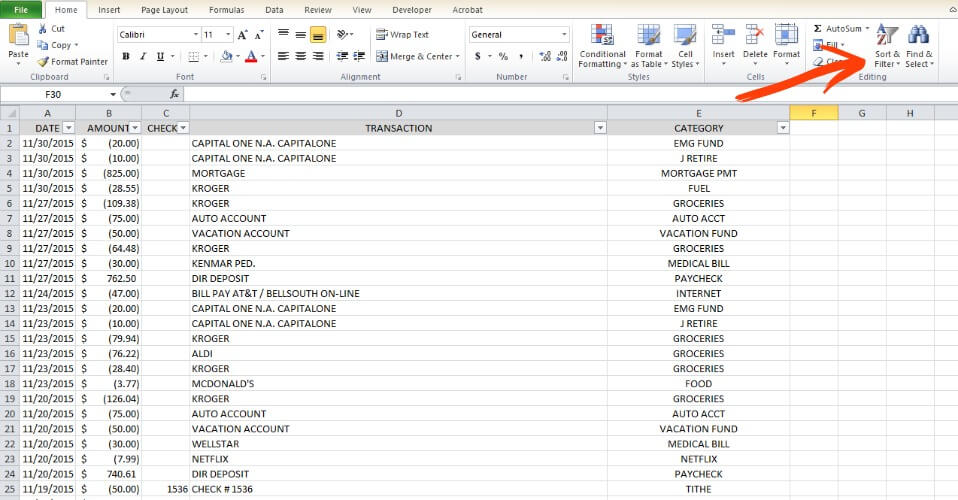

After you have your excel file pulled up, I recommend you insert a row above the first line. Just right click on the number one on the left hand side and select insert. Then label your columns accordingly.

I like to make a separate column and label it category. This way as I’m going through my transactions, I can just label them whatever category of our budget they should belong in.

For instance, all of our grocery purchases would be under the category “groceries” and all of our entertainment (movie rentals, fun outings, etc.) would be categorized as “entertainment”. If you aren’t sure, what a purchase is put it under the category “miscellaneous”.

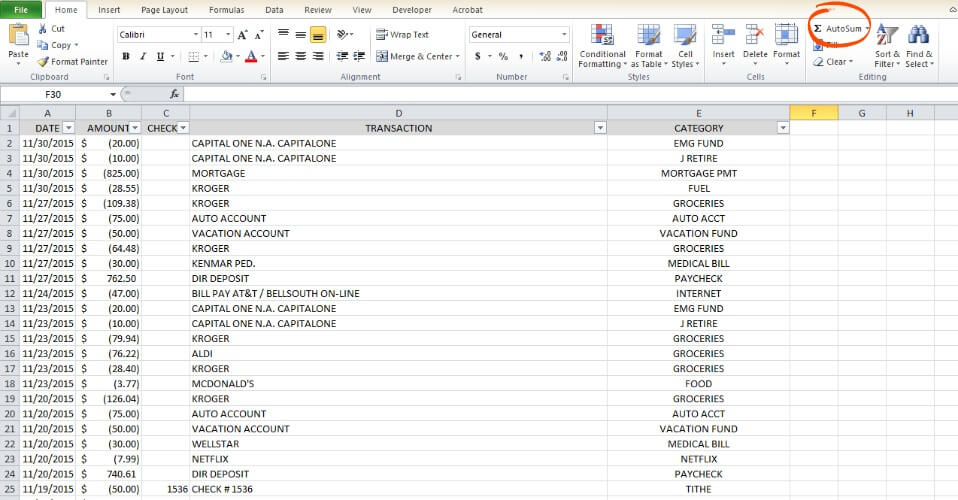

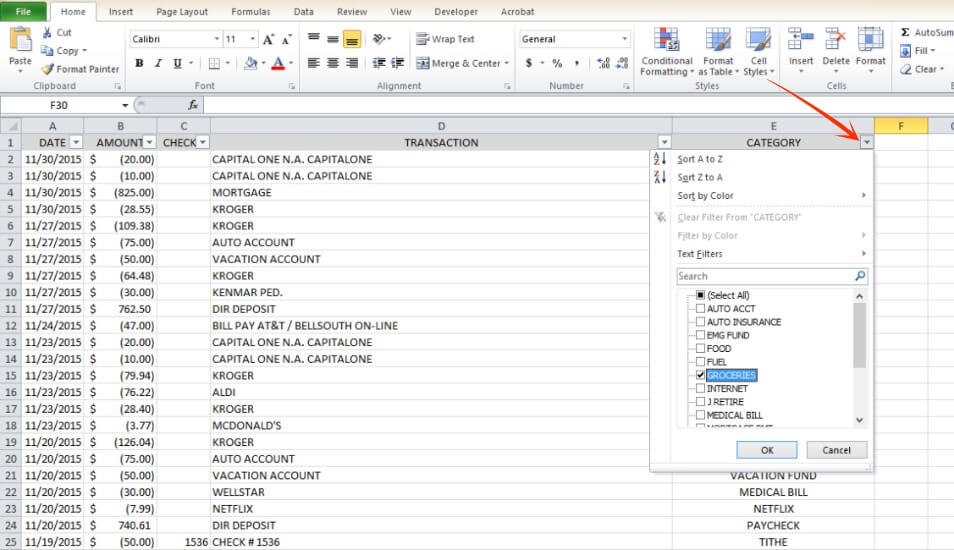

Once you have everything categorized, highlight the top row and select “sort and filter” and then select “filter”. Now, you should have a dropdown menu where you can select certain categories to show at a time.

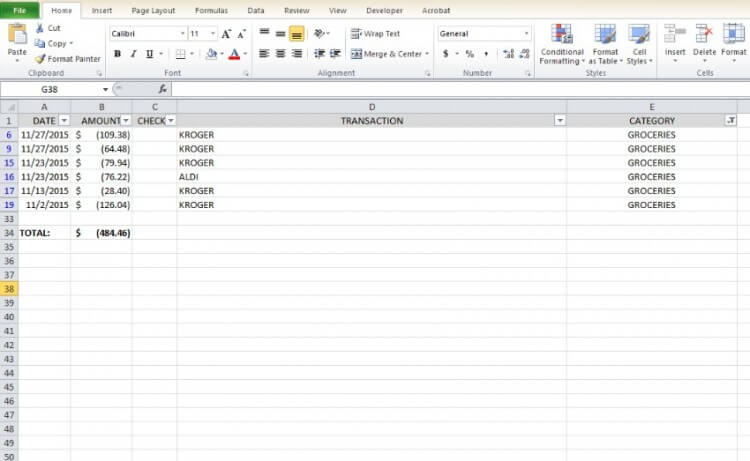

After you’ve done all this, scroll to the bottom of your “amount” column and select a blank cell under that column and then hit the “AutoSum” button to sum up all your totals.

Now, when you select certain categories, it will automatically sum up those categories for you. As you go through this with each of your categories, write down your totals for each column. This way you’ll know which categories you’re spending the most money on and you can start assessing if those expenses are necessary.

Ask yourself:

Is this category necessary to our survival (shelter, food, or transportation to and from work)?

Why is this category so high? What did we buy/spend the money on?

Is there anything we can do to lower this category?

From here, determine if you should keep this category in your budget or if you can remove it. If you decide to keep it in your budget, decide if you can lower it or not. If you can’t lower it, you’ll need to repeat this process with all of your categories until you have your expenses lowered enough that your income exceeds your expenses for the month in your budget.

Hopefully this will help you figure out where you need cut expenses from your budget and what you should be budgeting for what. If you need more help with budgeting, these are a few other posts that may be able to help you:

The Beginner’s Guide to Budgeting

How We Paid off $5,000 of Debt in One Month

JOIN THE CHALLENGE!

Money controlling you? I know the feeling. My family has been living this real life on a budget for a long time and I can tell you that there's never a perfect season, but with a few changes you can start to reign in your money issues.

Join the 5-Day Challenge today and start getting your money life in order this week!

We did something very similar to this when we started on our debt free journey. You’re right, it takes so much time and it is definitely worth it…but for me, it was a little embarassing! I was ashamed of how much money went towards things that should not make up a huge part of our budget. It was one of those harsh, slap you in the face realities like “Oh crap, need to get my stuff together!”

I always love a good spreadsheet. 🙂 Great resource!